Publicité

Energy transformation meets Investment Banking

Par

Partager cet article

Energy transformation meets Investment Banking

The challenges facing the Mauritian economy in this digital world are numerous. Not only the country needs to catch up its technological gap with advanced countries but it also has an urgency to develop the right ecosystem to fuel future development. Investment banking, a term extensively used these days locally, is known to be a very niche segment in banking. The local regulator for this matter has already been subject to the same usual criticisms namely in the allocation/control/oversight process. From a pure information concentration standpoint, which is crucial in a regulatory framework, it is very puzzling to comprehend that the banking and investment licenses are being awarded by separate bodies. On these matters, the Central Bank authority should always prevail. In reality, countries having an investment banking culture have seven factors in common, large banks/insurances, a hard currency, a vibrant stock/bond market with big companies quoted on serious venues, a very good regulatory framework, strong rule of law, high quality human capital and a good technological infrastructure.

Unfortunately, Mauritius does not possess most of these 7 elements. But the authorities still wants to attract these players, which in my opinion, will be either of very small size or the ones with an average track record seeking for refuge as they are not able to access the big financial centres. However, with some innovative ideas, there is a possibility to develop some areas in investment banking with existing local banks, and gradually other activities will graft on it. It’s only in this manner that an expertise would be created along with the development of an ecosystem. Evidently, this will require some risk taking mentality, time and the right human capital. The questions to be asked right now are: what are the developments that will increase the potential output of the country; making it more resilient knowing that we have a soft currency and at the same time develop the local expertise.

One of the avenues the country should explore is the energy transformation of the island. For such a small piece of land, gifted with sun exposure practically any given day of the year, there is a need to transform the energy production/consumption. Mauritius still produces a large part of its electricity though oil run turbines. Basing our Energy power supply on an underlying which is volatile, quoted in a hard currency, can prove to be dangerous in a world where geopolitical tensions are omnipresent. So, is there a way where it would be possible to embark in the Energy independence of the island by equipping electricity producing solar panels to every household/ small businesses at no(or very little) cost and still boost the existing financial ecosystem of the country.

The main objective of such endeavour should be therefore the following:

- Reduce the energy consumption based on fossil products

- Mass install the country with electricity producing solar panels

- Innovative financing methods which will improve the investment banking culture

- Creation of a local venture capitalist tissue

And the constraints:

- Bureaucracy with legacy players in the local electricity scene.

- Understanding of market risks

- Lack of transparency

- Cronyism

In December 2015, the international climate accord in Paris took place. The main conclusions were the global reduction of emissions and on the innovative avenues on the financing of renewable energy. Any discussion of increasing the deployment of residential solar must address its relative climate benefits. In short, the devil is in the details. The installed costs for residential installations run approximately twice that of utility scale projects on a per Watt basis.

Mauritian Environment

The residential market’s major advancement has been its business model to address the inherent challenges of rooftop installations. After all, residential solar is a capital and labour intensive enterprise. System prices vary and according to size, but they average approximately between 150,000 MUR to 350,000 MUR for 3.5-5KWatt. Given the average monthly earnings (tradingeconomics.com) is around 26,331 MUR, we can reasonably purport that the purchase of such system is affordable to most of the middle class household. From a purely rational economic perspective, it may make sound financial sense for wealthier households to switch to rooftop solar. The utility bill savings provided by generating solar power may create a positive net present value for the project. However, few households take the time to analyse their monthly electric bill, let alone calculate the return on a hypothetical solar installation. Even if they did the analysis, liquidity would present a problem to most households. The amount of upfront cash required to purchase the system outright dissuades all but the super wealthy from buying a solar system.

The household solar industry is gradually becoming a consumer credit and lending business focused on customer acquisition. Solar providers have developed two main financial contracts to acquire these solar panels.

Leases and Power Purchase Agreements (PPA): The household pays a monthly fixed MUR/kWh rate below their previous utility bill, creating a difference in prices that translates to value. While the lease payment typically escalates at some percentage per year, the household pays no upfront cost for the panel installation or the operations and maintenance; the company owns the system. Power Purchase Agreements (PPAs) are similar to leases, but differ in that PPA holders enter into a contract to buy the system’s power at a predetermined MUR/kWh rate.

Loans: Loans are the financial arrangement in the residential solar market. Rather than offer leases, solar providers grant loans to homeowners, allowing them to purchase the system and then make interest payments until the maturity of the loan. The debt product can still involve an annual escalator.

In the PPA proposition, the provider will need to manage three set of flows:

- Payments of clients

- Credit given by the government for electricity produced

- Tax credits from government

This paper won’t be going in the last two points because the legislation around renewable energy is not that clear.

To democratize the solar panels, there need to be a solution which facilitates the access to these systems and incite households to switch to them. Consequently, banks can intervene in bridging the mismatch between financing and ownership of these systems by the use of a technique called securitization.

Enter Securitization

What we know of the Mauritian market for these systems are the following:

- The scheme to have solar panels is limited in time.

- Only a few households have access to it due to price and financing scheme.

- Excess energy produced is being sold to the provider

- Solar services framework offered by provider are constantly changing

- Mauritius carbon footprint is not satisfactory for such a small island.

In order to remedy to these pitfalls, there can be a solution by using securitization to finance the mass equipment of solar systems to households/businesses. Securitization is a form of off balance debt financing. Its purpose is mainly to transform an illiquid asset to a more liquid one through the issue of a financial security, a bond most of the time. Securitization is being used to engineer credit derivatives such collateralized debt obligation (CDO) amongst others. Even if these instruments have been much been vilified during the 2008, they did had some very strong advantages.

The idea of securitization resides in pooling of claims with different characteristics in order to create some sort of diversification and then issue a financial instrument, most of the time, a bond which will pay a coupon and reap a given yield to investors given the rating (given by a rating agency) and the type of risk this instrument bears. Normally, to distinguish between these risks, there is a tranching* which is made where the less risky instrument will have a lower return than the high risk paper. The more risky the form paper, the more equity like it is. There will also be a credit enhancement mechanism which can protect the layers, by allowing insurers to guarantee part of the layers, hence climbing up the rating score ladder.

Solar Securitization

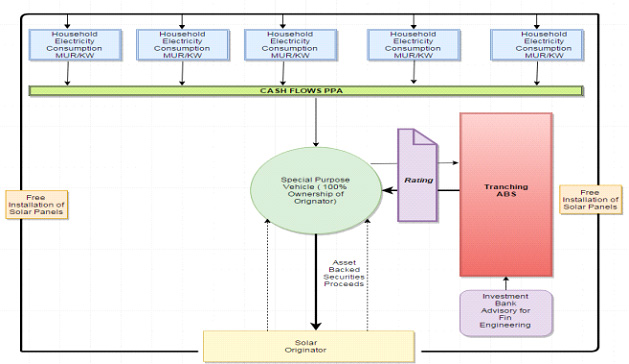

The provider (originator) which can be an electricity company, or a joint venture between an electricity company and a bank, would use a standard legal structure known as special purpose vehicle (SPV) which will enable to take out the credit/bankruptcy risks associated from this venture from their balance sheet on one hand and the other hand, allow to collect the payments of thousands of rooftops which generate monthly cash flows. Then, SPV will issue new debt securities based on the cash flows from these PPAs. Fixed income investors would buy these solar asset backed securities and receive coupon payments along with a yield on their capital invested. In return, the provider will receive financing at relatively low costs and yield given the capital intensity of the residential solar project. It would then be possible to deploy these systems everywhere in the country at cheaper costs for households/businesses.

A model to explore for Mauritius

The essence of the scheme which Mauritius can explore should put the banking sector in the centre of the game. As an example, the legacy distributor of electricity should work along a bank who would act as an advisory partner in the securitization process. To be attractive to households/small businesses the scheme should have the following features:

- Free installation of brand new solar panels that are given for free.

- Strike a contract between provider and households on a 25 yeas basis.

- Households should be paying for their consumption at a lower K/Watt price compare to market price in order to create value proposition for clients

Let’s assume that Mauritius wants to install solar panels for 30,000 households and businesses as part of phase 1 deployment. The monthly electricity bill should be currently around 2,500 MUR (but less than 5,000 MUR) on average for these households/businesses. The unit cost for a 3.5-5K/Watt solar system is normally around 150,000 MUR after discount(tax rebate and other incentives also) for a volume purchase(single unit is around 365,000 MUR). Hence, the total cost for financing such project would be around 4,500,000,000 MUR.

At this point, the provider could take a straight loan to finance the project and lease the solar panels. But this would stress out dramatically the balance sheet of the unique provider of electricity. Knowing how these government sponsored bodies are managed, this can prove to be detrimental to their very existence if such charge would be mismanaged. However, a bank with some expertise can structure a deal which will encompass fixed income securities along with a tranching process through securitization. This would have the following advantages:

- Remove the credit/bankruptcy risk from the provider through its SPV.

- Achieve the energy transformation at much lower costs.

- Save on fossil product imports for government.

- Issue new securities backed by PPA contracts to deepen the fixed income market.

- Enhance the bond market with offering of new yield products for investors.

- Increase the expertise of asset backed securities in the local banking environment.

The following diagram explains the structuring:

Tranching Process

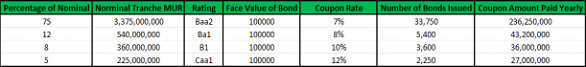

The bank, through its SPV, should issue for 4.5 B MUR of fixed income securities. In order to incentivize investors, the bank would undergo a tranching process where it will slice this nominal value in 3 to 4 pieces of fixed income issues of different rating with a different coupon rate. The highest rating would receive a lower coupon rate and the lowest rating would receive a higher coupon rate. Bearing in mind, that Mauritius bears a rating of Baa1 from Moody’s, we would expect that the highest rating for the super senior tranche to be of at least Baa2. A proposed tranching could be the following:

Let’s assume the 30,000 households would pay a monthly bill of 1500 MUR (with solar panel) on average which would create value proposal of 500 MUR to 1500 to each household. This would generate monthly revenue of 45,000,000 MUR which would turn into a yearly figure of 540,000,000 MUR. As this point, we will need to account for a default/delinquency rate on payments, for simplicity, we assume this to be around 2%. We have a final amount of 529.2M MUR. So each coupon date, the SPV would service the payments which will be around 342.5 M MUR. This leaves us with a residual amount of 186.75M MUR. On this amount, there will be a deduction of maintenance costs, servicing costs or insurance costs (this specific could be eventually shared with the client) would amount to 50M MUR per year. The insurance (approx. 40% of the amount) will cover mainly the likeliness of a more than expected default rate or a major cyclonic event. An annual amount of 135.25M MUR will remain, of which the investment bank (around 2 to 5 % plus retainer fees) will take its commission for advisory, on-going risk management, best effort agreements and the rest can be invested each year in an insurance policy for a bullet payment after 25 years, here I took an interest of a yearly 6.5% which gives after 25 years 7,596,510,537.69 MUR with which the principal must be repaid i.e 4.5B MUR at maturity. Thus, a net amount of 3.096 B MUR will be left for the provider for future investments. Consequently, this will produce these effects:

- 30,000 households/businesses were equipped with solar panels

- Asset Backed Securities issues enhancing the fixed income market depth

- Market making on these instruments

- Will create a secondary market for these papers for investors seeking yield and capital appreciation

- Improve the efficiency of the provider are it will need to service the coupon for investors

- Increase the expertise of banks in structuring and risk management

- Create a secondary market for solar panels or used ones

- Reduce the reliance on fossil energy

- Enhance the local rating industry and calculation of risks.

Financial Sector

This whole process has many advantages for the financial ecosystem. Firstly, it offers yields to investors, if they choose not to adopt a “Buy and Hold” behaviour, these papers would be traded over the counter and yield will start to appear. Thus, portfolio manager will be able to have exposure on solar investments and hence diversify their portfolio. For Banks, it will enhance their comprehension of structuring processes and calculation of risks. As a matter of fact, this will internalise expertise of asset backed securities, structuring, pricing, layering of tranches and risk management. For example, financing very big projects like the Metro Express project along with other project finance loans can be structured through securitization for other credit derivatives. The other benefit would be the better comprehension of rating agencies of the local environment/market and thus a better assignment of prices on various risks. Consequently, it will be possible to insure against those risks. However, there are some important precautionary rules which should be taken such as

- Serious Due Diligence and Credit Scoring of Households( like FICO score in the US)

- Banks should be able to model default rates and correlation inside the pool of PPAs dynamically. This demands a high level of financial engineering.

- Ability for provider to provide the infrastructure that give all services mentioned

- Provider should be ready to smooth out between peak and off peak consumption

- The provider should have very good governance policies

Conclusion

The above paper describes how a public good such as electricity, produced in an innovative and renewable way can be financed by innovative financial techniques. By this manner, not only the financial sector will beef up in terms of expertise but it will also limit the carbon footprint of the country by the democratization of solar panels. The financing of big projects is often viewed as a daunting task as many unknown factors can appear which can endanger the profitability of the venture. Governments are normally the right entity to take such risks on such a long period but with the support of banks and financial markets financing can be done as risks can be pooled, diversified and shared. However, solar securitization’s future ultimately resides on the business models and technologies that spurred the residential market in the first place. The growth in the sector to this date, while very significant, does not hinder the need to address major regulatory and policy hurdles. A more sustainable, less regulation-dependent business model will be needed. Technology cannot be ignored, either. More innovation is needed to drive down costs and spur deployment of residential solar. Without those fundamental developments in parallel, the future success of residential solar—and its novel financing—will remain uncertain.

Publicité

Publicité

Les plus récents