Publicité

Sometimes your best investments are the ones you don’t make*

Par

Partager cet article

Sometimes your best investments are the ones you don’t make*

The financial sector in Mauritius is often portrayed as a vivid contributor to the national output. This comprises the offshore sector and other financial services. The recent changes in the local and global environment will much likely have some consequences on this sector. We heard about new regulations/incentives, fancy words related to the finance-technology complex, setting up of derivatives exchange but we must admit the path to become a competitive player in these segments is systematic and any amateurism or wrong diagnostic will be a sure road to failure. The financial sector of Mauritius suffers from a time lag weakness when it comes to the pure value added activities in investment banking. But that does not mean that the country can’t become a relevant player in some ancillary activities, I am talking here of support or at best product control ones. These activities still demand a good level of human capital where the knowledge and practice of different financial instruments are needed. After having written about the economy and about the financial sector, I will elaborate about an unknown segment of the financial industry which is the asset management industry. Having a deep asset management industry is vital for the development of the financial ecosystem. Every relevant financial centre in the world possesses strong expertise in managing funds, because it drives the pension/insurance money into performance related vehicles. Having a minimum knowledge of the local stock market, I decided to design an investment strategy with an objective to maximise long term returns. The goal is to verify if a lack of knowledge of fundamentals of the local market is detrimental to performance. Most funds managed by Portfolio Managers in Mauritius are fundamentally driven, meaning that the analysts will examine the companies quoted on the local market, and then will proceed with their so called stock picking skills. I don’t believe in stock picking, and research shows that it is very rare to demonstrate these skills in the long run. So any stock picking skills revealed in the short run is called luck. At times, locally, investments are not even governed by the in depth analysis but by cronyism where managers or their chiefs will invest in funds where they can reap higher distribution/kickback fees. There are so many stories where a meeting of minds is done at the expense of the investor. So, the due diligence role along with the fiduciary behaviour which any market operator is entitled to respect disappears.

There are often reports about those managers who have maintained consistent returns which have beaten their benchmarks. However, these managers can be counted on one hand if we start from 1970. It’s very difficult not to say impossible to forecast the funds which will do better next year. The failure to predict has given rise to a business model which is very much known in the financial world – playing Mystic Meg*. For example, media like Bloomberg or CNBC are always pushing their guests to give stock tips, insights or any investment tips. Why can’t we deed the information obtained on these media to trade? The main reason is that specialists will likely exploit the news and this will drive up the prices well before any uninformed investor is a chance to act. That’s why most important news is announced when markets are closed. But we all know, that so called experts in these matters have a terrible track record. There has been research on the stock tips given by experts, and the results are daunting (see Jim Cramer, the “(in) famous” stock picker). The only forecast based on past performance that works is the forecast of which funds will do badly. Funds that have done really poorly in the past do tend to perform poorly in the future. So, celebrating any money manager for his recent performance is not only a foolish game but proves to be detrimental in terms of performance in the medium term. Just because a manager beats the index last year does not mean it will continue this year. The probability of this event is not greater than the probability of flipping heads in the next fair coin toss. We can reasonably say that mutual funds are most likely a random walk as the market. Evidently, there are exceptions to the rule, he is called Warren Buffett. There might be other examples but it’s very difficult to know them in advance. There is a survival bias embedded to that.

In Mauritius, there is a stock market which is currently listing 41 common stocks. Banks, Hotels, consumer discretionary and real estate related companies are the main sectors. Many funds, managed by either banks or their subsidiaries, invest in these stocks to create a portfolio of Mauritian stocks. This portfolio will generate returns which will try to beat the benchmark i.e the SEMTRI. The motto is often “In the long run, you will never lose with stocks”. This phrase is conceptually wrong as depending on the timeframe picked, there can be periods where stocks are very bad investments which mean equity premium does not always pay. There can also be change in the cost structure of the investor which makes him review his investments, so that any specialist saying that if you had invested money 25 years ago you would multiply your capital by x times is a very broad and unrealistic statement. For example, France had 66 years of negative returns when it was only 16 for the US. Do the small investors ready to wait for such long time?

Preceding the buying of any stock, there is a research which is undertaken on the financial health of the company. Usually, the manager will review/analyse the accounting statements of the company, the sector, it’s market share vis a vis the local/global environment, its pricing power, the risks associated and eventually use a quantitative model to assess if the stock is cheap or expensive. The metrics often used are the price earnings ratio, price to book, price to sales or more recently the CAPE ratio. He will also try to diversify his portfolio either through different sectors or different asset classes, i.e. by including fixed income instruments for instance. In normal market conditions, stocks can appear reasonably independent. When there is a rising market, most stocks go up and good stocks go up even more. Most stocks have a high correlation to the overall equity index, either locally or/and internationally. However, in a downward trend market, the correlation gets even higher, sometimes approaching the perfect causality. Everything takes a hit at the same time. This tends to validate that in an all equity portfolio, diversification has its limits and portfolio managers are, in fine, just holding varying amounts of beta*. The lack of diversification in equities is a factor that it’s critical to be aware of. For pure equity strategies, there will always be a substantial amount of beta position. The more stocks you will hold in a portfolio, the closer your strategy will resemble like the index. Taking beta* risk deliberately is not always a bad thing as long as the portfolio manager knows it.

The objective of this article is to design a dynamic and systematic investment style that will resist to a downward trend in market, avoid over trading/betting and still generating significant returns. Scanning the all equity funds in Mauritius, they seem to track the index, for some very poorly for others barely at par. The main funds on this segment posted an annualised 7.4% since inception (the 90s) and the newer ones were on the negative sides for some and for others around 5% annualised return since 2006. Reading the factsheet of one of the fund, there are as usual the classic statements why the fund didn’t do well or other fundamental reasons why the performance is not in line with the forecasted returns. In a matter of illustration, we will take two local funds* which will act as guinea pigs (noted for simplification as GP1 and GP2). The name of the funds will not be disclosed for obvious reputational consequences. The funds have the following characteristics:

- Invested mainly in Mauritian Securities (Equities)

- Multi Strategy

- Long Only (Takes only Buy Position)

- High Degree of “Diversification”

- Liquidity

- Fund asset under management a bit under 1 billion Rupees.

- Long Term capital appreciation

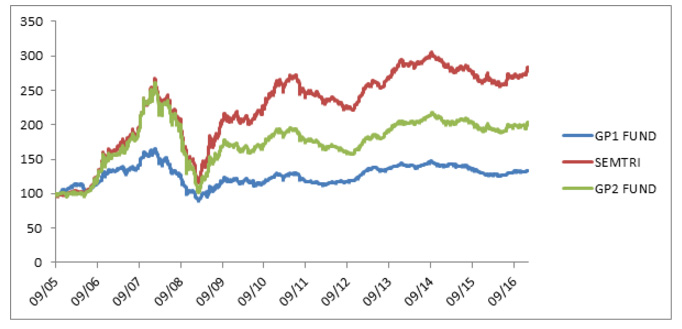

The performances of the funds plus index are as follows:

As we can see in the above diagram, GP1 and GP2 Funds never beat the SEMTRI index but are still highly sensitive to any downward shock of the broad market. If an investor would have invested 100 MUR in 2005, he would double his capital with GP2 fund after more than 10 years and with GP1 he would still below the underwater level of pre 2008 peak. They are both subject to downward shocks. Any investor, who entered the fund before 2008, would be in a positive return territory only as from end 2013. In terms of performance, the compounded annual geometric return for GP1 is 2.32%, GP2 is 5 % and the index is around 8.4%. The question to be asked, is whether the management fees billed does justify such kind of performance? In the US, active managers are rewarded based on the alpha* they generate. Turning beta return into alpha one was very common trick in the past years but much less now as fees should justify the skills of the manager and adapted to the sources of returns. So, we should ask ourselves, if these fees charged by banks do demonstrate some skills or it’s just pure gambling labelled as so called expertise/deep knowledge of the market. If it’s just a gamble, then a systematic strategy will normally outperform any portfolio return out there. This is the case because with the law of large numbers, with a close to normal distribution as hypothesis, any systematic actions have slightly more than 50% chance to be successful. A 52% chance of beating the index is considered to be a good figure.

Enter efficient hypothesis violation

The essence of the investment strategy is to have a systematic approach. Stock picking or manual modifications of any existing portfolio based on whatever news, tips or fundamentals are banned. Machine language (C++ here) is used to write the code rules, data are being retrieved from a Bloomberg Terminal. The objective of the strategy is as follows:

- Achieving consistent long term returns and compounding wealth

- Limiting the downside risk

- Absence of discretionary portfolio management

- Portfolio will need to adapt to the market dynamics

The constraints are the following:

- Plugging out the strategy is not recommended

- Strategy should be proprietary to avoid front running and market footprint

- Will not be more reactive than a discretionary portfolio.

- Staying out of markets for a significant time.

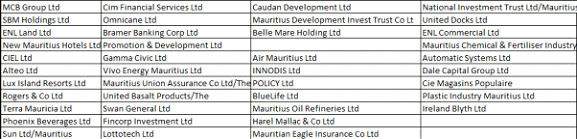

The Equities Universe the strategy is based on the following:

Due to the size of the stock market and the liquidity on certain stocks, there can be some unintended consequences on the final results. Right away, we need to add a survivorship bias in this list meaning that only companies which survived on the investment period are in this list. Rigor would advise to include the dead or delisted companies in the list as well but due to a lack of data, the testing will be done on the above list. The strategy will start as of 2005 and must include different market regimes i.e trending, tail risks and mean reversion.

Philosophy of strategy

Bearing in mind that the rules are not complicated and this article is no way an investment advice, I will not plainly disclose them to avoid an improper utilization of it. However, an extensive explanation of these rules will be given in order for the initiated reader.

The strong form of efficient market hypothesis (EMH), originated from Eugene Fama research, states that all information are in the price of any stock listed on a market. This theory has been challenged by many researchers and some high profile hedge fund managers. However, there are some caveats to that which EMH does not consider. They are the irrationality of investors and the attempt to exploit mispricing. The efficient market hypothesis predicts that prices reflect fundamental value. Why? Smart investors are greedy and any mispricing in the market is an opportunity to make a quick profit. Human beings are not rational 100 per cent of the time. Anyone who has driven without wearing a seat belt, or hit the snooze button on an alarm clock, this should be pretty clear. Nobel Prize winners Daniel Kahneman and Amos Tversky speak of System 1 and System 2 when it comes to our behaviour. System 1 is the “think fast, survive in the jungle” portion of the human brain. When we start to run away from a poisonous serpent, even if later on, it turns out to be a stick, we are relying on our trusty System 1. System 2 is the analytic and calculating cavity of the brain that is slower, but always rational. When we are comparing the costs and benefits of refinancing a mortgage, we are likely using System 2. For example, when System 1 begins making System 2 decisions, we are highly likely to get into trouble. Situation like “ That diamond bracelet is so beautiful, I just had to buy it” or “Home prices never go down, we always need to throw money in real estate”.

If we combine irrational investors with arbitrage limitation or any market irritation, there could be a situation where compelling investment opportunities for initiated investors. Thus, we get this market irritation which exists on many venues which is:

Behavioural bias + Market Irritation = Mispriced Assets.

Back to our strategy which will take advantage on this above assertion on the price returns. The strategy will analyse the propagation of the returns of all the stocks listed and smartly choose those stocks that have statistically the best chances to outperform the market using a ranking method. In this step, the time-frame parameters should be chosen depending on the inherent market structures. For example, we can use returns over the past 6 months or one year.

Asset Allocation

The asset allocation of the portfolio is independent of sectors. The strategy will only invest in 10 equities and the rest will be in cash. There is no assumption to be made on the state of economy, financial metrics or any fundamental factor which is said to affect any stocks. This style does not distinguish between value and growth stocks. There is no fixed income component per se which can eventually enhance the portfolio returns or limit the risks. The only specificity is when the portfolio is all in cash, this can be invested in some government bonds for the period there are no active equity positions.

Weights

Sizing each position is very important in terms of risk management. The strategy adopts a countercyclical approach for each weight so that it takes a lower weight if the stock is being more volatile. This will enable the portfolio to resist to some negative shocks or mean reversion process in volatility.

Rebalancing

The whole purpose of this investment style is a systematic timing. This means the positions would be reshuffled once or twice a year to keep up with the market dynamics. Stocks not meeting the core conditions are sold and replaced by new ones respecting them. Each position is adjusted in order to be in line with its volatility. In between, there is only a risk monitoring. With this frequency, it also helps to reduce transaction costs.

Downward market indicator

In order to reach significant returns, the portfolio should be riding the good stocks when they are going up and be out of the market when the market as a whole is going down. To be in line with this rule, there is an embedded downward market triggering point which is in the public domain. It uses exponential moving average.

Difficulties with implementation

With the lack of liquidity on certain stocks, it can prove to be more difficult to buy these stocks without leaving a footprint on the market. That’s why this should normally be tackled by slicing the buy orders on many days thus degrading the buy price. As the local market is very small, the different players interacting sometimes have vested interests and this is often not in the interests of the shareholder. The regulator is also known to have a very passive role. There is always a risk of front-running. The infrequent traded and flat electroencephalogram stocks are ignored.

Results

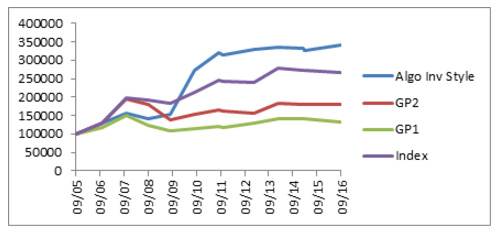

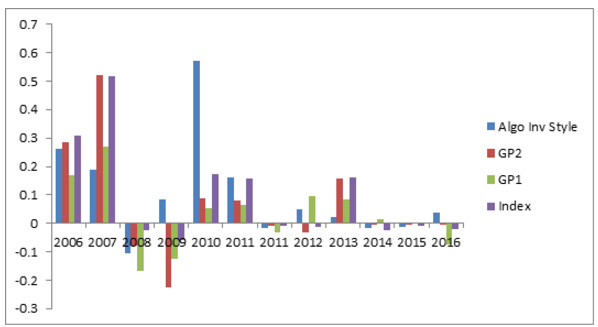

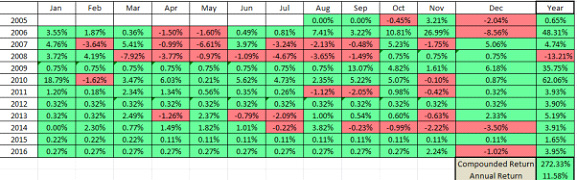

The results are pretty much revealing. With an investment of 100,000 MUR in 2005 in the Algorithmic Investment Style, after more than 12 years, this capital will be around 380,472 MUR which corresponds to a compounded annual return of 11.58 %. For GP2, the capital would grow to 182,722 MUR with a compounded annual return of 4.75% and if an investor invested in GP1, the equity would have been around 133,239 MUR with a compounded annual return of 2.42%. Concerning a buy and hold strategy, which means that if we could hold all the components (with same weight) of the SEMTRI index from 2005 to now, the equity balance would be topping 276,089 MUR with corresponds to a return of 8.83% annual. The annual volatility of these 3 investment vehicles are 18% for the Algorithmic System, 19% for GP2, 12.2% for GP1. The index bears a volatility of 17.4%. The Algorithmic Investment Style does have a higher volatility (compared to GP1) due to its all equity investment space whereas the GP1 and GP2 do have a fixed income component. During the period in which the Algorithmic System is out of the market, the proceeds of the portfolio are transformed into cash and could be invested in a deposit account or a treasury bills (91 days Treasury). This will not only enhance the risk adjusted annual return but would also lower the volatility.

Analysis

The above grid is a detailed decomposition of monthly returns inclusive of the fixed income investment when strategy is not holding any equities. The red cells are unrealized negative performances. Note that the strategy does not modify its holdings monthly so the returns showed only acts as an illustration and they are not compounded monthly( with no monthly compounding the performance is 10.7% annually compounded). The Algorithmic Investment Style does bear some negative returns especially during the first months of any downside shock but it then recovers well from any drawdown. This strategy looks robust in terms of performance. It does have some embedded equity risk as it is invested only in local equities. It can be pointed out here, that dividends obtained are not reinvested. So, we can reasonably purport that performance would be better if this would be the case. In order to assess the general risk/return profile of the strategy, the gain to pain ratio (GPR) can be useful. It measures the returns in relation of the risk taken by the portfolio. For the algorithmic strategy, it is more than 3 which is considered to be good, any figure more than 1.5 is called to be beneficial. The Sharpe Ratio* is 0.6 for the Algorithmic portfolio, 0.35 for GP2, 0.26 for GP1 and 0.57 for the index. Before concluding, let’s recap a bit about some harsh realities in investment:

- Market prices are often far disconnected from any classic measure of fair valuation. Sometimes market prices are too high given the prevailing fundamentals; sometimes they are too low.

- Markets are impossible to beat which means that some experts beat the market because they are skilled and it’s not just always luck.

- Price moves commonly lag changes in fundamentals. Also, sometimes prices are driven by emotional factors rather than fundamentals.

- High returns for a market or sector are more likely to be followed by subpar, rather than superior, performance, especially in return/risk terms, picking high-return long-only funds would also be expected to result in sub -average performance.

- There are times where high past returns reflect excessive risk taking in a favourable market environment rather than manager skill. This risk may not be evident in the track record if the risk is episodic in nature and no risk events occurred during the life span of the fund. Understanding the source of returns is critical to evaluating their implications and relevance.

Conclusion

The goal of this paper, even if technical at times, is to show how a well-studied investment strategy can be implemented on the Mauritian stock exchange. For simplicity, the coding and scientific terms were voluntarily discarded. The initial assumption was to verify if a lack of fundamental analysis of the listed stocks is detrimental to the construction of a long term returns generating portfolio. The answer is clearly no. The dynamics of the local market can be exploited to build a completely algorithmic system which from the returns it generates is outperforming significantly two major local funds and the index. The major banks and independent asset management firms all have Mauritian funds incorporated in their investment offer. They publish lengthy reports about the fundamentals of firms, often of very poor quality. Their portfolios also often mixed up some foreign stocks with other bonds. This has the advantage to diversify their investments but when looking at their returns, we can ask ourselves about the skills of the managers or the role of whole asset management industry. Is it a performance driven industry or just a conduit to invest funds in the main stocks of the stock exchange. We do hear every day about financial services and still when looking at the global performance of local funds, there are some questions to be asked. The asset management industry is very important in the development of a financial sector, so the skills which are being developed in it should reflect innovation and expertise. Asset management, for a large part, is about returns and trust. Competition drives up innovation and this is often seen in the investing style of managers. Otherwise, there can be an outburst of various investment offers of poor regulatory quality which not only discourage investors to use the existing channels but also create a parallel world where Ponzi or Pyramid schemes are norms. In a nutshell, the asset management industry contributes to the allocation of capital between savers and borrowers. The intermediary by which this happens depends on a unique ecosystem where expertise, technology, trust and a calculated risk taking mentality are of utmost importance. But Mauritius is known to be lagging behind on all these factors mainly because of the fee economy the financial sector has become due to overconcentration. As a matter of fact, it will be very hard for Mauritius to catch up on its own the other financial centres. For example, Casablanca, which launched the Casablanca Finance City in 2014 is already well ahead of Mauritius because it attracted the right players and was ready to welcome back highly qualified human capital of Moroccan nationality amongst others. Online forums or any events to gather ideas operated by government promotional agencies with local experts will never hatch out any transformational movement. In economics and finance, it’s well known that only competition and contrarian views help price discovery of any asset, human capital included. If Mauritius does not comply with these non-stated rules, the jurisdiction will be structurally of meagre importance.

The opinions expressed in this article are those of the author and only from him. The materials and commentary are strictly informational. This article is not intended to provide investing or other advice or guidance with respect to the matters addressed in this article.

Publicité

Publicité

Les plus récents